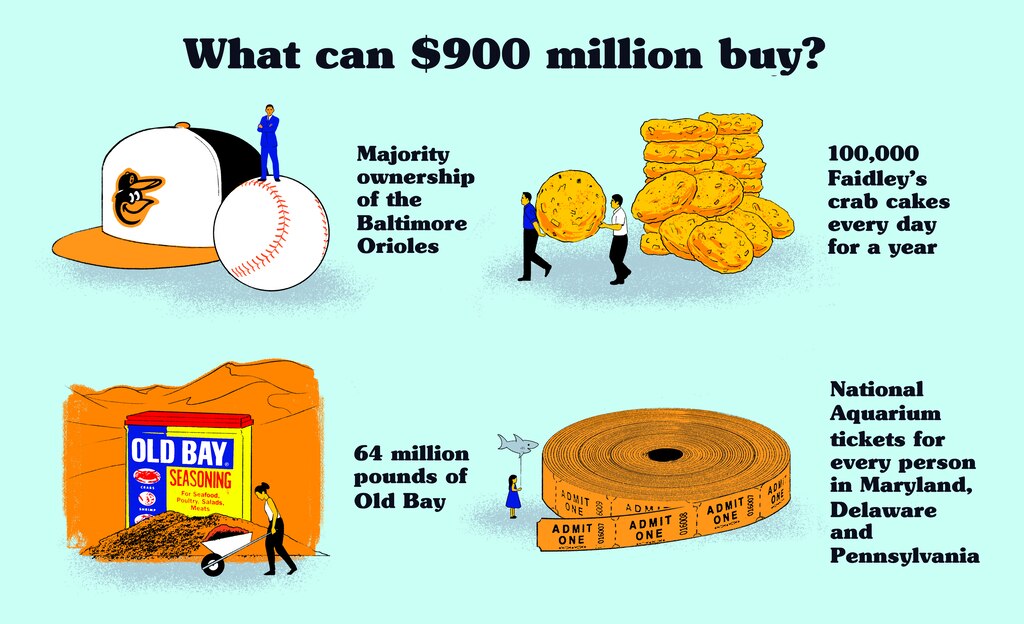

Baltimore’s Inner Harbor redevelopment is projected to cost in the neighborhood of $900 million. By any measure, it’s a lot of money.

It’s enough money to secure a majority ownership of the Baltimore Orioles; buy nearly 100,000 Faidley’s crab cakes every day for a year; buy 64 million pounds of Old Bay; and cover the cost of a National Aquarium ticket for every single person in Maryland, Delaware and Pennsylvania.

The bulk of the money is coming from private investors, at least under the current plans from developers MCB Real Estate.

Things could still change, but the project now calls for $400 million in public funds, all from the State of Maryland and the federal government. Baltimore hasn’t been asked to pony up beyond a $1 million contribution to predevelopment costs.

That much public money could go a long way toward helping with some of Baltimore’s most pressing issues.

Among those is affordable housing. Developers have touted the current Harborplace plan as inclusionary, and a new mandate in Baltimore requires new developments to offer some units to lower-income tenants, if they are receiving or plan to apply for any major public subsidy. They would have to reserve up to 15% of their units for households that earn less than the the Baltimore area median income. Rent for those units would be capped at 30% of the renter’s pre-tax income.

Read More

This story is part of a deep dive into the future of Harborplace

The plan calls for 900 total units. If the maximum 15% are reserved for affordable housing, that would mean 135 affordable units.

Based on how much the city spends on tax credits for affordable housing – at least $14,000 per unit per year – $400 million could pay for more than 2,850 units for 10 years.

Vacant housing is another problem in Baltimore, one the city and state are already tackling. Mayor Brandon Scott’s current ambitious plan calls for $3 billion over 15 years, including a $150 million in tax increment financing (TIF) and $900 million from the state to help refurbish or demolish some of the thousands of vacants in the city. There’s already been a 19% reduction in vacant homes since 2019, but another $400 million in public money would go a long way.

A 2022 study from the Johns Hopkins University estimated the cost of renovating vacant housing in the city at $100 to $200 per square foot. Using the high-end cost estimate of $200 per square foot, then $400 million could fully renovate 1,000 of Baltimore’s more than 13,500 vacant houses if they’re about 2,000 square feet in size.

That’s a conservative estimate, and renovating these houses is more expensive than tearing them down and building new ones. But based on these numbers, $400 million could cut the number of vacant units in Baltimore by 7%.

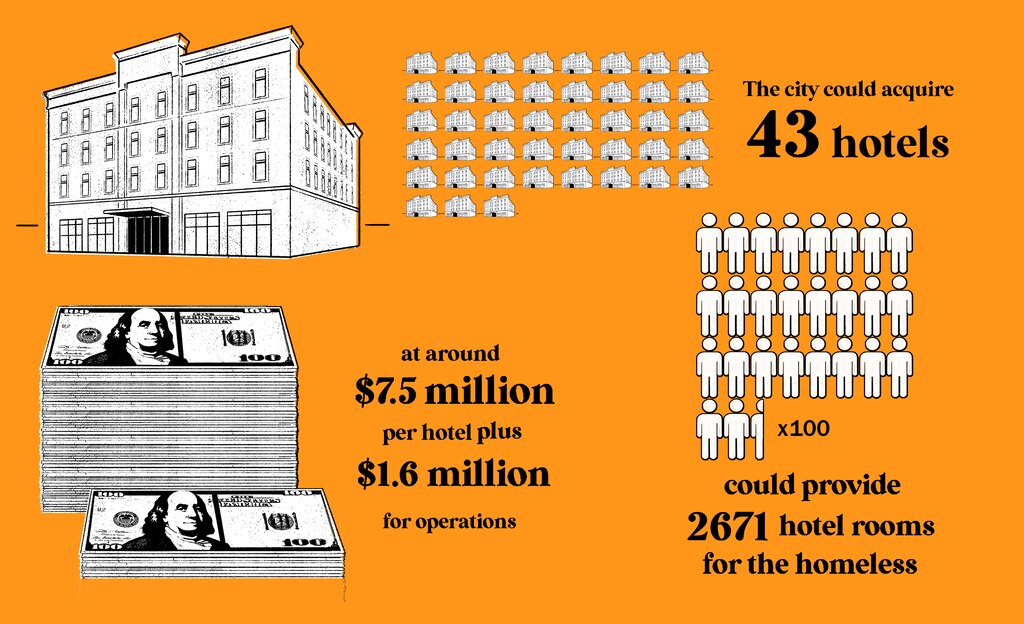

$400 million could also greatly help Baltimore’s homeless population. The city recently acquired two hotels for $15.2 million to add to its stock of beds for homeless people. It’ll cost another $3.2 million for nine months of maintenance and operations.

At around $7.5 million per hotel, plus $1.6 million for operations, the city could acquire another 43 similarly sized hotels, and run them for nearly a year. The average size of those two hotels was 65 rooms. At that price, the city could buy 2,671 hotel rooms, and pay to maintain them for a year.

Or they could house homeless people in renovated vacant housing. The 1,000 vacants the city could afford to rehabilitate could house around two-thirds of the city’s point-in-time count of its homeless population last year, or more if units were split up or shared.

City officials stressed that this isn’t an either/or situation. They say we can have a redeveloped Harborplace, affordable housing and fewer vacancies. And much of this money is earmarked for specific purposes, including the renovation of the promenade.

Comments

Welcome to The Banner's subscriber-only commenting community. Please review our community guidelines.