The hedge fund is displeased.

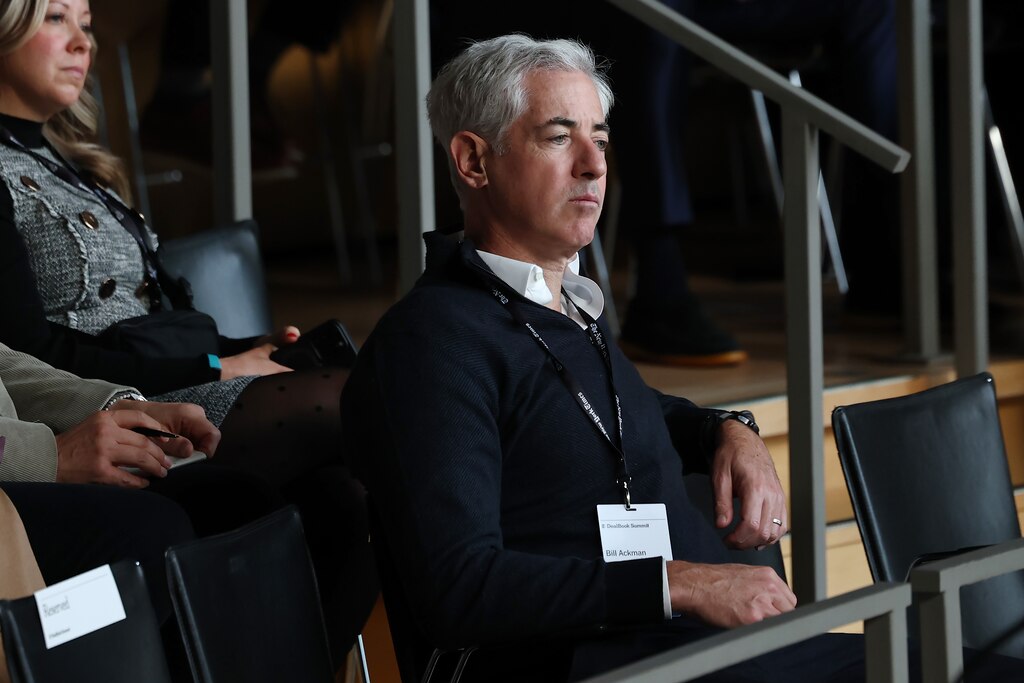

Billionaire Bill Ackman of investment firm Pershing Square made that much clear in his letter Monday to Howard Hughes Holdings, the Texas-based developer that owns much of downtown Columbia.

Pershing Square owns a 38% stake in Howard Hughes and has been frustrated for months with the company’s stock price. Ackman’s letter this week put Howard Hughes’ board of directors on notice that the firm now wants to pay $1 billion to snap up more of the developer’s stock with the intent of a merger.

It’s not clear what the hedge fund ownership could mean for Columbia, which was founded in 1967 by James Rouse as a model of racial and socioeconomic integration.

The Baltimore Banner thanks its sponsors. Become one.

If the deal is completed, the Maryland town soon could find its interests aligned with that of a private equity firm headquartered in New York.

Howard Hughes is major landowner in Columbia and a key player in the planned community’s 30-year master plan, which includes major redevelopment projects such as a new library.

Representatives for Howard Hughes Holdings and Howard Hughes Corp. did not respond to requests for comment Monday. The company acknowledged receipt of the letter in a late Monday filing with the Securities and Exchange Commission that said it “does not intend to comment further on this matter unless and until further disclosure is determined to be appropriate or necessary.”

Howard County spokeswoman Safa Hira did not respond to a request for comment. The Columbia Association’s board of directors declined to comment through a representative.

The hedge fund executive’s 14-page letter states a merger would not change business for master planned communities like Columbia, which “deserve a well-capitalized, diversified, long-term owner and manager who understands not just its fiduciary obligation to shareholders, but also its obligations to the hundreds of thousands of current residents and the millions in the future, who will live, work, study, marry, build and grow families, and play in our communities.”

The Baltimore Banner thanks its sponsors. Become one.

The hedge fund does not intend to make any changes to the organization and expects all employees, including Howard Hughes CEO David O’Reilly, to remain in place.

Pershing officials believe Howard Hughes is poised to start generating excess cash beyond what it needs to fund its development efforts and that money can be deployed to turn the company into a “modern-day Berkshire Hathaway,” the investment conglomerate managed for years by Warren Buffett, to acquire controlling interests in operating companies.

Pershing is offering to pay $85 a share to grow its stake in Howard Hughes to between 61% and 69%. In addition to the hedge fund’s $1 billion investment, the real estate company would spend $500 million repurchasing shares, Pershing proposed.

Shares of Howard Hughes Holdings mostly traded over $100 each for several years before the pandemic, but plummeted to under $50 as the coronavirus spread. While the share price rallied back over $100 in 2021, it slipped back in 2022 and had mostly traded between the mid-$60s and mid-$80s since then.

The stock price jumped Monday as news of the proposed merger broke. Share prices closed at over $78 in New York Stock Exchange trading, a more than 9% increase.

The Baltimore Banner thanks its sponsors. Become one.

Ackman has a long history with Howard Hughes; he served as the company’s chairman for years.

Companies looking to acquire other entities typically offer a premium to entice shareholders into selling, said Christina DePasquale, an associate professor with the Johns Hopkins Carey Business School. The share price jump suggests the market responded somewhat positively to the hedge fund’s offer, though it’s too soon to tell whether the plan will come to fruition.

Frictionless mergers can take six months to a year to finalize, she said. Legal or regulatory hurdles could arise and stall the deal.

Comments

Welcome to The Banner's subscriber-only commenting community. Please review our community guidelines.